Crop Insurance and Planting Dates

By Dusty Sonnenberg, CCA, Ohio Field Leader: a project of the Ohio Soybean Council and soybean checkoff.

With near record warm temperatures for early April and ideal ground conditions, it is very enticing for farmers to start the 2021 planting season earlier than normal. Current research from Dr. Laura Lindsey, Soybean and Small Grains Specialist at The Ohio State University shows that planting date has the greatest impact on determining final soybean yields. But many farmers look at the calendar and also consider the crop insurance implications to getting this earlier than normal start to the season.

Jason Williamson, of Williamson Crop Insurance says that farmers are covered if they plant early, but the replant portion of their policy may not be. “The most common question I have gotten this week is what is the earliest date I can plant with my crop insurance,” said Williamson. “There are actually two answers to that question.

If farmers want to plant right now, they will have a bushel guarantee. The only thing they give up right now is the replant coverage. Crop insurance has initial planting dates, and that varies by county in terms of what your initial plant date is for replant coverage to occur.”

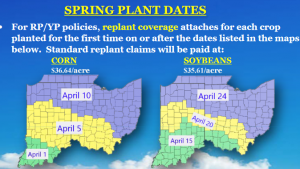

The initial replant date for corn in much of northern and eastern Ohio is April 10th, and for soybeans it is April 24th. For the more southwest part of Ohio, the initial replant Corn date has just passed. It was April 5th. For a lower third of the state, the soybean initial replant date is April 20th, and for a group of 10 counties in the extreme southwest portion of Ohio, the soybean initial replant date is April 15th.

The initial replant date depends on the type of crop insurance policy the farmer has. “Coverage that is either Revenue Protection (RP) or Yield Protection (YP) are standard within the policy to have an initial planting date,” said Williamson. “Corn and Soybeans planted after the initial replant date have replant coverage. Corn and soybeans planted prior to the initial replant dates have coverage and a bushel guarantee, they just don’t have replant coverage. These are only for the RP and YP coverages.”

There are some other coverage options available through the Approved Insurance Providers (AIP’s) that are private products, known as a replant endorsement. “The AIP’s also want to encourage folks to get the crop in earlier, because of the potential for the higher yield,” said Williamson. “These products give the farmers earlier planting dates for those crops so that they will have the security of having replant coverage, even if they go a little early. Some range from 10-20 days early depending on the product.” Farmers should be sure to consult their crop insurance agent to ensure what specific coverage they have in place.

Two other areas farmers need to consider this time of the year from a crop insurance standpoint include: failed wheat termination, and also cover crop termination. If a farmer is planning to destroy an insured wheat crop, it must be appraised by an adjuster prior to termination. A crop insurance agent can review the options when planting a second crop following failed wheat. It is advised to contact the crop insurance agent immediately to submit a claim if a wheat crop is in question.

Best management practices involving cover crops continue to evolve, and the practice of “planting green” is gaining momentum. From a crop insurance standpoint, a cover crop must be terminated within five days after planting or before the crop emerges (whichever is first) for the spring crop to be insured.

Communication is the key to having the correct information to make the best management decisions possible. “Farmers should make sure they are communicating with their agent,” said Williamson. “When we get into problems is when things are unknown, or made known after the fact. Talking to your agent prior to taking action is a key.”